Can Core Winding Machines Meet the High-Precision Motor Coil Demands of the Booming New Energy Vehicle Industry?

The global transition towards electric mobility is accelerating, with projections indicating that new energy vehicles will comprise over 40% of total automotive sales by 2030. Underlying this transformation lies a fundamental manufacturing challenge: producing motor coils that meet unprecedented standards of precision, efficiency, and scalability.

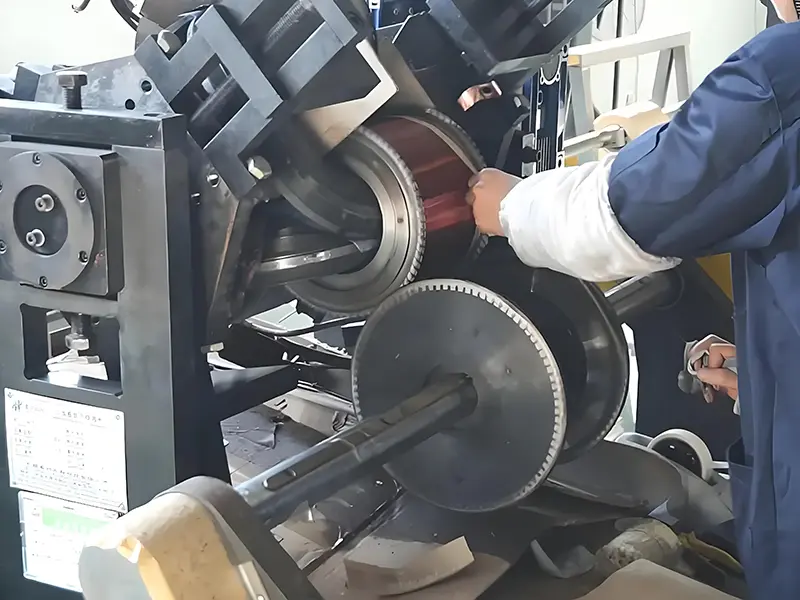

That’s where core winding machines come in. They’re not exactly glamorous — but they’re essential. These machines build the electromagnetic guts of every EV motor. And right now, the whole industry is watching: can they keep up with the NEV revolution?

We’re diving into what’s next for this key sector — the tech advances, market shifts, and new ideas shaping the future of winding.

1. The NEV Surge: Why Precision Coils Are Non-Negotiable

Electric vehicle (EV) traction motors, power electronics, and transformers rely on coils wound around magnetic cores to convert electrical energy into motion or regulate voltage. Unlike traditional internal combustion engines, EV systems demand:

Tighter tolerances: Motor coils must maintain consistent resistance, inductance, and thermal stability to prevent energy loss and premature failure.

Higher power density: Compact designs require coils to handle extreme currents without overheating, necessitating advanced insulation and winding patterns.

Scalable production: Automakers aim to slash manufacturing costs through mass production, pushing winding machines to achieve near-zero defect rates at speeds exceeding 1,000 parts per hour.

For instance, Tesla’s Model 3 Permanent Magnet Synchronous Motor (PMSM) uses coils wound with a pitch accuracy of ±0.05mm to minimize cogging torque—a critical factor in driving range and smoothness. Such precision demands machines capable of micrometer-level control.

2. Core Winding Machines: Evolution of a Critical Technology

Core winding machines have evolved from manual tools to fully automated systems integrating robotics, AI, and real-time monitoring. Modern machines fall into three categories, each addressing specific NEV applications:

2.1 Transformer Core Winding Machines: Powering EV Charging Infrastructure

EVs rely on transformers to step down high-voltage grid power to battery-compatible levels. Transformer core winding machines must handle:

Laminated steel cores: These require precise layering to minimize eddy current losses.

Multi-tap configurations: Adjustable winding ratios enable dynamic voltage regulation for fast-charging stations.

High-speed automation: Siemens’ latest transformer winding lines achieve 1,200 turns per minute while maintaining ±0.1mm layer alignment, reducing energy waste by 15% compared to older models.

2.2 3D Coiled Core Winding Machines: Enabling Next-Gen Motor Topologies

Axial flux and radial flux motors—popular in EVs for their compact, high-torque designs—demand 3D winding patterns that traditional machines cannot produce. 3D coiled core winding machines use:

Multi-axis robotic arms: To wind coils around irregularly shaped cores, such as those in axial flux motors used by Rivian and Lucid Motors.

Simultaneous multi-wire feeding: Some systems wind up to eight wires in parallel, cutting production time by 70% for hairpin-wound stators.

AI-driven path optimization: Algorithms like those from Japan’s Nidec Corporation reduce material waste by 12% by calculating the shortest winding routes for complex geometries.

2.3 Toroidal Core Winding Machines: Revolutionizing Power Electronics

Toroidal transformers, found in EV onboard chargers (OBCs) and DC-DC converters, offer lower electromagnetic interference (EMI) and higher efficiency than traditional designs. Toroidal core winding machines must:

Handle fragile nanocrystalline cores: These materials require non-contact winding to avoid structural damage.

Maintain uniform tension: Variations as small as 0.5N can degrade coil performance, necessitating servo-controlled tensioning systems.

Integrate laser welding: Automated welding of coil ends improves reliability, with machines like those from Switzerland’s Schleuniger achieving 99.98% defect-free joints.

3. The Precision Gap: Where Current Machines Fall Short

Despite advancements, gaps persist:

Material compatibility: Silicon carbide (SiC) and gallium nitride (GaN) semiconductors in EV inverters require coils with thinner insulation (≤50μm), which many machines struggle to handle without puncturing.

Thermal management: High-frequency switching in SiC-based systems generates heat that can deform coils during winding. Solutions like liquid-cooled mandrels are emerging but remain niche.

Cost vs. precision: Multi-axis 3D winding machines cost up to $500,000—prohibitive for small-scale suppliers. Startups like Italy’s Coilmaster are developing modular systems to democratize access.

4. Innovation Pathways: Bridging the Divide

To meet NEV demands, the industry is pursuing four strategies:

4.1 AI-Powered Quality Control

Machine learning models analyze real-time data from sensors embedded in winding heads to detect defects like loose turns or insulation gaps. For example, Germany’s Bühler Group uses computer vision systems to inspect 100% of coils at 800 parts per hour, reducing scrap rates by 30%.

4.2 Hybrid Winding Techniques

Combining robotic precision with human-like adaptability, hybrid systems like those from South Korea’s LS Mtron use collaborative robots (cobots) to handle delicate tasks (e.g., winding around sharp core edges) while automated feeders manage bulk processes.

4.3 Sustainable Manufacturing

Recycled copper and biodegradable insulation materials are gaining traction, but winding machines must adapt. Newer models incorporate laser cutting to minimize material waste and closed-loop systems to recycle cooling fluids.

4.4 Open-Source Ecosystems

To accelerate innovation, companies like Tesla and BYD are sharing winding machine blueprints for core components like hairpin stators, enabling third-party suppliers to align with their standards.

5. The Road Ahead: 2025 and Beyond

By 2025, the global core winding machine market is expected to grow at 6.8% CAGR, driven by NEV demand. Key trends include:

Self-calibrating machines: AI-driven systems that adjust parameters in real time to compensate for material variations.

Quantum winding algorithms: Early research at MIT suggests quantum computing could optimize winding patterns for maximum efficiency in seconds, versus hours for classical methods.

On-demand manufacturing: Cloud-connected machines that download NEV-specific winding programs, enabling factories to switch between models without retooling.

Conclusion: A Precision-Driven Future

The NEV industry’s success hinges on core winding machines that blend speed, accuracy, and adaptability. While challenges remain, innovations in AI, robotics, and materials science are closing the precision gap. As automakers like BYD and Volkswagen invest billions in vertical integration, winding machine makers must collaborate across the supply chain to turn today’s limitations into tomorrow’s breakthroughs. The race to electrify mobility is, at its core, a race to redefine what’s possible in coil winding.